Information Page On Difference Between Assignment Vs Nomination In Life Insurance

Buy Life Insurance in under 5 minutes and Save upto 75%*

Nomination and assignment difference

The words, assignment and nomination, are commonly used in life insurance policies. While not everyone understands them, it is critical to know the meaning and difference between assignment vs nomination before acquiring any insurance plan.

The primary distinction is one of policy ownership. The policy owner remains constant while under nomination. An assignment, on the other hand, transfers policy possession from one individual to another. The advantage is paid to the nominee (as in nomination) post the demise of the life assured, but the advantage is paid to the assignee (as in assignment) when the life guaranteed passes the rights and possession of his/her plan to the assignee. There are some fundamental and prevalent distinctions between the nomination and assignment.

This article will elaborate some more about assignment and nomination, and the role played by them in insurance.

What exactly is life insurance nomination?

Among the most important aspects of a life insurance policy is nominating. The policyholder must designate a family member as their own nominee. If the insured person dies, the nominee is regarded as being qualified to receive the advantages of the life insurance policy. In this method, the insurance company makes sure that the insured’s family does not face financial difficulties even if a salaried member of the family dies. As a result, the insured should exercise caution while selecting the candidate for his or her insurance policy.

Nominee types in life insurance

The policyholder has the option of selecting one out of the five sorts of nominees. Let’s take a closer look at them. The five distinct kinds of nominees in life insurance are as follows:

1. Beneficial Nominee

Instead of the nominee, IRDA has coined the term “beneficiary nominee.” It indicates that the owner of the policy has the authority to appoint anyone as their nominee. The property owner’s guardian/parent, kid, or partner can be chosen as the nominee. If the insured has already picked a nominee, there will be no conflict in receiving the claim.

2. Minor Nominee

To ensure the future of the kid in their absence, a policyholder may designate his or her younger child the chosen beneficiary of his or her life insurance policy. However, if the insured person dies prematurely, the amount claimed will be paid to the child’s official guardian or an appointee. When the child reaches the age of 18, the caretaker transfers the money to him or her.

3. Non-Family Nominee

The insured may also select an outsider as his or her candidate. However, this is not usually advised.

4. Multiple Nominees

According to the insurance policy of multiple nominees, the policyholder may choose two or more people. In this situation, the owner of the policy splits the total sum among the two nominees. In case the policyholder fails to split the amount when filling out the nomination form, the insurance company divides the claim sum equally among the nominees.

5. Changing Nominee

The policy owner can choose his or her candidate under this sort of nominee during the term of the life insurance policy.

6. Successive Nominee

In many cases, people want to select multiple nominee; in consecutive nominations, one might select a maximum of three nominees. The benefit for death will be paid to the first candidate upon the demise of the insured. If the first nominee dies, the benefit for death will be paid to the second nominee, and so on.

What you must know about nominations?

There are quite a few fundamental aspects of nominations which any policyholder should be aware of. The following are the most crucial facts concerning nominations:

- For the purpose of nominating, the life guaranteed and the insured should be the same under the life insurance contract. If they are two separate people, the claim for rewards will be utilized by the insurance scheme’s policyholder.

- The candidate has no authority to propose changes to the insurance policy.

What is a life insurance assignment?

There exists an opportunity for assignment in life insurance as per Section 38 of the Insurance Act of 1938. The policyholder transfers his or her policy owner’s rights to a different individual. The assignor is the individual that transfers the rights, and the assignee is the person to whomever the policy rights are passed. The assignee thereby acquires the legal proprietor of the policy of insurance.

People typically select banks to assign their policy rights. The bank replaces the policyholder, while the insurance policy’s life assured remains same. The bank receives the advantages of the claim (policy owner).

Life insurance assignment types

In life insurance, there are two types of assignments: absolute assignment and conditional assignment.

- Absolute Assignment

The entitlements to a life insurance policy are granted to another individual (assignee) without any limitations and conditions in a complete assignment. In general, policyholders perform this type of task to express their affection for somebody or to return a bank debt.

- Conditional Assignment

The policy owner (assignor) assigns the entitlements to the life insurance coverage to another individual (assignee) according to the particular terms and conditions in a conditional assignment. Only when the terms and circumstances are met will the rights to the policy pass on.

What you must know about assignments?

Look at the most important aspects of the assignment you must always remember:

- The assignment solely impacts the insurance policy’s owner. The life assurance will remain unchanged.

- Each insurance plan’s owner has the option to transfer the rights to an assignee. Solely the insurance policies and pension plans that were purchased under the Married Women’s Property Act (MWP) are exempted.

- If the policyholder transfers the entitlements to his or her insurance coverage to the insurance company in order to repay the insurance company’s loan, the authorization of the insurance policy is terminated.

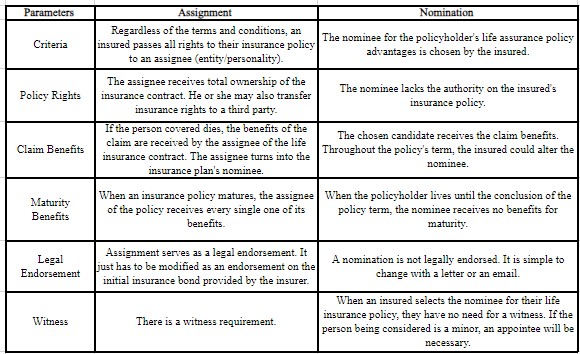

Nominations and assignments variances

The table provided below offers a quick overview of the various distinctions between nominations and assignments.

Conclusion

It is critical for a policyholder to understand assignment and nomination. This is due to the fact that both nomination and assignment possess their own set of advantages that the policyholder can take advantage of immediately. As a result, with the assistance of this post, a whole piece of knowledge has been delivered. It is advised that policyholders get the correct life insurance coverage that will benefit their family members even if they are not present.