Difference Between Annuity & Life Insurance

Buy Life Insurance in under 5 minutes and Save upto 75%*

Life can be highly uncertain and this is mainly why it becomes necessary to get an insurance coverage that will look after the financial needs of your family in case of your demise. Considering what you need financially, your retirement goals could provide you an advantage when selecting the best insurance plan. Life and pension insurance both make excellent long-term insurance plans. They vary in their significance, advantages, terms and conditions so on.

Nevertheless after your demise, life insurance gives financial assistance to those you love. There are regular premiums as well as rider advances. Annuity, however, is a form of retirement savings which offers you with financial stability once you reach retirement age.

In simple terms, life insurance is beneficial if you happen to perish before the expiration of your policy term period, while an annuity is beneficial if you survive the term period.

What does life insurance policy mean?

Life insurance is a deal between your insurer and you. The contract specifies the amount of security you bought as well as any other essential information. A life insurance policy is made up of many distinct parts that work together to form the whole contract for insurance. One of these elements is the details you provide when applying for a policy. To implement the contract, the life insurance proposal should accurately state the insured’s previous and current health issues, as well as high-risk manners.

Ways life insurance policy works

When deciding between annuity and term life insurance, it becomes crucial to comprehend how each works. Once the insured person dies, the life insurance policy gives financial assistance to the insured’s family. The insurance policies have legally binding contracts. They provide money benefits to assist the family in bearing the financial burden caused by the insured’s demise.

- The insured person has to shell out the premium amount in twelve or yearly instalments, based on their choice of payment method.

- If the insured person expires over the policy’s term, the assured amount is distributed to the designated beneficiaries.

- Certain insurance policies also include benefits for maturity. If the individual survives the policy period, the insurance business provides the guaranteed funds.

- To collect the guaranteed sum, the beneficiaries must file a claim.

- The money could be claimed by submitting the insured person’s death document. Beneficiaries receive money after verification.

Different types of life insurance policies

Life insurance is essential and provides a wide range of coverage. The primary aim of a life insurance policy is to protect your family’s financial security after you die. Thus, before choosing to purchase life insurance, research the different kinds of life insurance available and what each of them can provide.

The various kinds of life insurance plans are as follows:

1. Term Life Insurance

Term life insurance offers basic coverage for a period of time that is specified by you. This is an excellent method for safeguarding your loved ones in the unfortunate circumstances of your premature death. Term policies are ideal for financially independent people who do not require or desire coverage above the sum chosen. Term plans are simply life insurance policies that have no maturity advantage.

2. Endowment Plans

Endowment program includes both a death and a maturity benefit. It offers cover for your unexpected demise as well as some savings. These kinds of plans may include straight endowment, money-back or child strategies, among others. These kinds of plans, however, are conventional insurance policies with guaranteed advantages and, if appropriate, bonuses.

3. Unit Linked Insurance Plans

The policyholder has the option to engage in the marketplace via investments in these types of plans. There are no guaranteed advantages in this case because both the death benefit and the maturity advantages are dependent on market success that is subjected to nothing lesser than the predetermined sum guaranteed.

Advantages of life insurance plans

Below-mentioned are some benefits of life insurance policies which must be considered when buying a life insurance policy:

1. Security against Misfortunes

Getting a life insurance policy provides you and your family a security against any catastrophic events which have the potential to increase your financial burdens. It also protects the wishes of people who have been experiencing a decline in their income with an increase in their age.

2. Tax Benefits

This type of life insurance coverage offers tax advantages to the policy owner. Section 80C of the Income Tax Act states that the death advantage, or sum obtained in the form of proceeds from life insurance policies, is tax-free. The premium spent for the life insurance policy is also deductible up to Rupees 1.5 lakhs. Furthermore, the benefit of maturity is tax-free beneath Section 10(10) D, depending on the terms and circumstances.

3. Loan Options

Most life insurance firms, particularly endowment plans, allow you to borrow money for your policy if you require it, almost eighty and nine percent of the settlement value is allowed.

4. Assured Income

This section ensures a steady income for your household. You have the option of receiving a lump sum payment at the moment of your demise, regular payments over time, or a mix of the two. They may utilize this money to cover the cost of electricity, home rent, education costs for their kid’s fees and a variety of other expenses. This implies that your loved ones will continue to be financially stable post your death.

What does Annuity mean?

An annuity, also known as a “pension,” is a succession of consistent, expected cash flows that are ensured for the remainder of your existence. This is accomplished through a lump sum/systematic expenditure. The sum of money that you obtain is the result of the financial company’s expenditure. This is an excellent source of income following your retirement that allows you to make plans for your retirement. You could choose whether your annuity is paid every month, quarterly, every half-year, or annually.

How does Annuity function?

An annuity plan is a type of long-term financial strategy. In this case, the insured has to pay a lump sum amount or multiple instalments of payments to get funds from the insurance company on a regular basis.

- An annuity is a type of income given to an annuitant when they reach the age of retirement.

- Therefore, when you put money into an annuity plan, you must select the age at which you want to obtain the annuity. Typically, this is between the ages of 55 and 60. This is known as the “Vesting Age.”

- The period between the time you invest and when you reach the vesting age is known as the Accumulation Phase. It is during this period that you are anticipated to accumulate your annuity corpus from which you will be supplied with an annuity of your choosing.

- You will be given the choice of selecting the “kind” of annuity from the choices that are presented at the moment of vesting, like:

- Life Annuity, that is, annuity would be offered to an annuitant till he lives but no money is paid to the nominee after his or her death.

- Joint Life Annuity, that is, annuity will be paid to the annuitant till he lives and post his demise the spouse receives the annuity till they survive. However, once both of them are dead, the policy would be terminated without any money being given to the nominee.

- Life Annuity that brings Return of Purchase Price, that is, the annuitant will get payments throughout his life, and upon his death, the named beneficiary would obtain the entire purchase cost as death benefits, and the policy will be cancelled.

- Annuity Certain of 5/10/15/20 years, that is, the annuity would be given for an initial period of 5/10/15/20 years before continuing for the rest of the annuitant’s life.

Different types of Annuities

There are mainly two types of annuities: immediate annuity and deferred annuity.

1. Immediate Annuity

Immediate annuity allows you to start getting payments as soon as you make the initial investment. In contrast to other kinds of annuities, the money paid can be obtained instantly, generally with interest, making this instrument appealing for individuals who are interested in anticipating the future pension earnings.

2. Deferred Annuity

A deferred annuity agreement is a form of annuity whereby the income/annuity will not be accessible to the investor till the expiration date that is set in the near future. During the period of vesting, the annuitant may take up to one-third of the complete corpus tax-free as per the section 10(10)A and must choose an annuity amongst the remaining two-thirds of the corpus.

Advantages of Annuity

Getting an annuity has several advantages, the most important benefit is undoubtedly a sense of relief for retirement or as a form of enhancement retirement. Certain major benefits of annuity are as follows:

1. Tax-efficient

The premium given for delayed annuity plans happens to be tax-free up to an amount of ₹1.5 lakhs per year as per the section 80CCC of the Income Tax Act (1961).

During time of vesting, the annuitant has the choice of taking a third of the whole corpus tax-free under Section 10(10)A, that can be used to cover early retirement expenditures. The remainder must be turned into annuity money that is taxed in the annuitant’s hands.

2. Flexibility

The commencement date of your annuity is adjustable, enabling individuals to postpone the buying of an annuity till a later stage of life, when their financial retirement objectives may have less of an effect on adjustments to their lives.

3. Increase in Income

Annuities could give the significant money that people need to add to or substitute their income.

4. Intergenerational equity

An annuity provides a reliable income over the annuitant’s anticipated lifespan. You are confident that regardless of what happens after you retire, you will still be able to live your subsequent life with dignity, without being dependent on anybody else for financial support.

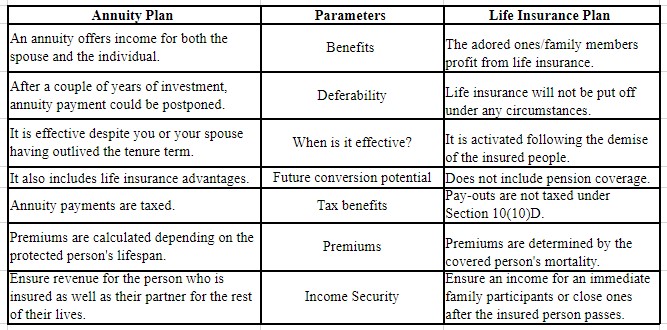

Differences between annuity plan and life insurance

Annuities and life insurance are both excellent financial investments. Despite their similar beliefs and conserving options, they vary in numerous respects. Knowing these distinctions will assist you in making the best investment decision.

What must be chosen between annuity and life insurance?

When contrasting life insurance and annuities, the most important element to consider is the reason for purchasing the financial product. Before deciding on any plan in particular, it is best to evaluate your financial situation and needs. You can choose between life insurance and an annuity plan based on your future requirements and priorities.

Life insurance offers financial assistance to your loved ones in the event of your death. It can cover your cherished ones daily expenses as well as other financial requirements. When you retire or cease to work, annuities supply you and/or your partner with an ongoing source of income. It is a retirement strategy designed to help you if you are no longer working.

Life insurance protects your family if you perish early on, whereas an annuity allows you to continue living peacefully post retirement.

Conclusion

Financial security is essential at all stages of life. You can choose between life insurance and annuity options based on your priorities and budgetary needs. In other words, both these plans offer substantial advantages to the insured person.

Dealing with unforeseen circumstances could be extremely difficult, particularly if it comes down to life and death. Ensure that you already have a strategy for how you will save money so that you will have the necessary resources to limit the potential damage when such unplanned events happen.

If you would like to offer financial security for your loved ones in the event of your death, life insurance is an excellent option. However, if you intend to safeguard a comfortable retirement, an annuity is the best choice.