Modified Bike? Here’s How It Affects Your Insurance Premium

Buy Health Insurance in under 5 minutes and Save upto 75%*

There’s nothing like customizing your motorcycle to express your personality. Upgrading the exhaust, getting a unique paint job, enhancing the suspension, or opting for wider tires—modifications allow riders to distinguish themselves. However, while your upgraded bike might attract attention on the road, it could also raise your insurance premium—often significantly.

In this article, let’s explore how modifications to your bike influence insurance costs in India, why insurers are concerned about those alterations, and what you can do to maintain coverage without emptying your wallet.

What Counts as a Bike Modification?

To begin with, what does “modification” signify in the insurance sector?

In straightforward terms, any adjustment that changes your motorcycle’s original specifications or performance as stated by the manufacturer qualifies as a modification. These may include:

1. Performance Modifications

- Engine tuning

- Aftermarket or free-flow exhaust systems

- Turbocharging or supercharging

- Changes to the air filter

- Nitrous kits (Yes, they are real!)

2. Aesthetic Enhancements

- Personalized paint jobs or wraps

- Stickers and graphics

- Neon or LED lighting

- Chrome accessories

3. Security Enhancements

- Theft alarm systems

- GPS tracking devices

- Disc brake locks

Not all modifications raise your insurance premium—but certain ones certainly do.

How Alterations to Your Motorcycle Influence Your Insurance Costs

When it comes to insurance, any modification made to your motorcycle can lead to one (or more) of the following three outcomes:

1. Heightened Risk

A faster motorcycle = greater potential for accidents. A more striking paint job = increased likelihood of theft. Insurance companies view specific modifications as additional risk factors. Increased risk results in a higher premium.

2. Boosted Value

Certain modifications (such as alloy wheels or high-end body kits) can elevate the market value of the motorcycle. If the cost to replace the bike increases, the premium will also rise.

3. Increased Repair Complexity

Aftermarket components may not be included under standard insurance policies. Moreover, they might necessitate specialized repairs, resulting in higher claim expenses. Insurance providers adjust the premium in response.

So, what’s the catch?

Not every modification leads to an increase in your premium. In fact, some (like enhancements to security) can lower it. The crucial factor here is being transparent and promptly declaring any changes.

What Are the Consequences of Not Notifying Your Insurer?

Imagine you customize your bike with a new wrap and exhaust but fail to notify your insurer. Sounds harmless, right? Not quite.

If your motorcycle is involved in an accident or is stolen, the insurance company may deny your claim for “non-disclosure.” That exhaust you loved could end up costing you the total repair expense.

Tip: Always inform your insurance provider before or immediately after making any modifications.

Different Types of Bike Insurance & Their Effect on Modifications

✅ Third-Party Insurance

Third-party policies protect against damages caused to others by your bike. Since they don’t cover your bike’s own damages, modifications are typically irrelevant.

However, be cautious: If your modified bike causes damage due to enhanced speed or power, you may find yourself in a legal predicament.

✅ Comprehensive Insurance

This type of insurance covers both third-party damages and your own. Modifications significantly influence your premium in this case. The greater the value or risk introduced by your modification, the higher the premium.

Insurer Classification for Modifications

Insurance companies generally categorize bike modifications into:

1. Approved Modifications

These comprise factory upgrades or professionally installed parts that do not affect safety (e.g., alloy wheels, windshield extensions). These are generally insurable with adjusted premiums.

2. Conditional Modifications

These might be covered with additional documentation or a higher premium (e.g., performance-enhancing parts, custom body kits).

3. Prohibited Modifications

Engaging in these modifications can void your insurance entirely—this includes illegal mods (e.g., color-changing headlights), racing setups, or any changes contrary to the Motor Vehicles Act.

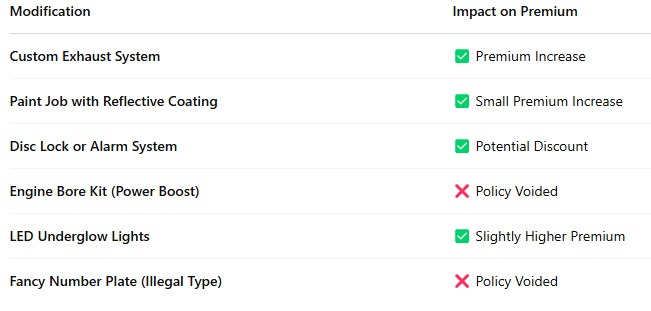

Real-Life Scenarios: What Increases Your Costs

How to Properly Insure a Modified Motorcycle ?

If you’re considering some exciting upgrades, how can you maintain your insurer’s satisfaction and keep your coverage intact?

Step 1: Check Prior to Modifying

Contact your insurance provider to find out which modifications they cover and what additional costs may apply.

Step 2: Obtain Written Approval

Always request email confirmation for any approved modifications. This can be beneficial during claims processing.

Step 3: Undergo Re-Inspection After Modifying

Some insurers may require an inspection of your bike following modifications. Be cooperative; it serves your advantage.

Step 4: Update the IDV

IDV stands for Insured Declared Value. A modified bike with increased parts value may necessitate a revised IDV.

Step 5: Maintain All Receipts

Keep documentation and installation records for every modified component. They will aid in substantiating value during claims.

Is Specialized Insurance Available for Modified Motorcycles?

Absolutely! Some insurance companies (particularly those that are digital-first) now provide customizable bike insurance policies, allowing you to adjust coverage based on modifications.

Look for:

- Add-ons for accessories

- Improved theft protection

- Coverage for custom parts

At Ginteja, we assist clients in comparing and selecting such customizable policies from reliable insurers—all while ensuring their unique bikes remain insured.

Final Words:

Ride with Style, but Stay Insured.

Modifying your motorcycle is all about passion, creativity, and individual expression. However, don’t let that enthusiasm jeopardize your financial stability. Always consult your insurer, disclose any changes, and inquire about how they impact your coverage.

A simple update on paperwork can prevent significant trouble down the line.