Life Insurance vs Mutual Funds: What’s Right for Your Family’s Future?

Buy Health Insurance in under 5 minutes and Save upto 75%*

In the current high-speed financial landscape, securing your family’s future is more vital than ever. With a heightened focus on financial safety, two key options frequently come up in discussions: Life Insurance and Mutual Funds.

Each serves as a valuable resource for distinct reasons, but selecting the right one can be perplexing, particularly when your main objective is to safeguard and enhance your family’s assets.

So, which option should you opt for? Life insurance or mutual funds? Let’s explore both alternatives in depth to assist you in making a well-informed choice.

Understanding the Basics

What is Life Insurance?

Life insurance is a financial product focused on providing protection. You make premium payments, and in exchange, your family receives a lump sum (referred to as the sum assured) in the event of your untimely death during the policy period. Some life insurance policies also provide maturity benefits if you outlive the policy term.

Categories of Life Insurance:

● Term Insurance: A straightforward protection plan that provides substantial coverage at low premiums.

● Endowment Plans: Merge insurance coverage with savings components.

● ULIPs (Unit Linked Insurance Plans): Deliver investment opportunities along with life insurance coverage.

What are Mutual Funds?

Mutual funds are investment options that gather funds from several investors to invest in stocks, bonds, or other types of securities. Their objective is to build wealth over time and are overseen by experienced fund managers.

Categories of Mutual Funds:

● Equity Mutual Funds: Invest in company shares; present higher risks along with the potential for greater returns.

● Debt Mutual Funds: Invest in bonds and fixed-income assets; carry lower risks.

● Hybrid Funds: Combine elements of both equity and debt.

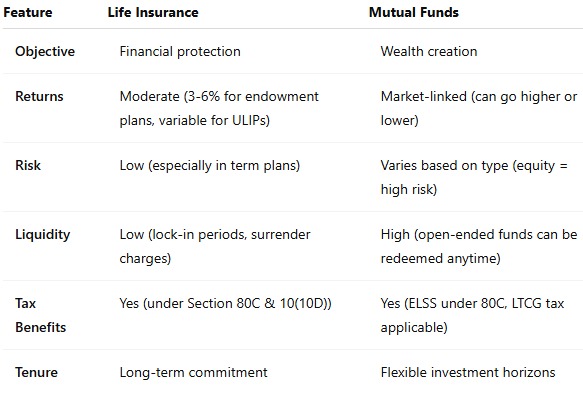

Key Differences: Life Insurance vs Mutual Funds

Which One Should You Choose for Your Family’s Future?

Choose Life Insurance If:

● Your main objective is financial stability: Especially if you are the only provider, life insurance guarantees your family’s financial well-being in your absence.

● You seek tax benefits: Premium payments qualify for deductions under Section 80C.

● You favor low-risk investments: Term plans provide reassurance with confirmed coverage.

For instance, a 30-year-old with dependents can opt for a term plan that offers Rs. 1 crore in coverage for an annual premium of approximately Rs. 10,000. This ensures that his family’s requirements are met in the event of his unexpected passing.

Choose Mutual Funds If:

● Your objective is to generate wealth: Mutual funds are well-suited for long-term objectives such as funding your children’s education, planning for retirement, or purchasing a home.

● You can embrace calculated risks: Particularly with equity funds, the longer your investment duration, the higher your potential for favorable returns.

●You seek flexibility: You can invest according to your financial capacity and withdraw funds whenever necessary.

● For instance: Contributing Rs. 5,000 each month into an equity mutual fund through a SIP for 20 years could potentially grow to Rs. 30-40 lakhs, based on market conditions.

Should You Combine Both?

Of course! Finding a balance is key.

● Purchase enough term insurance to safeguard your family’s financial well-being.

● Consistently invest in mutual funds to build wealth over the long term.

In this manner, you can enjoy the advantages of both: security and growth.

Common Myths Busted

⊛ “Life insurance can be viewed as an investment.”

– That’s not entirely accurate. Only ULIPs merge the two, and they frequently involve higher fees.

⊛ “Mutual funds are reserved for specialists.”

– That’s incorrect. With SIPs and expert fund management, novices can invest with confidence.

⊛ “I’m too young to consider life insurance.”

– In fact, the younger you are, the lower the premiums will be!

How to Begin?

For Life Insurance:

● Evaluate your financial requirements.

● Opt for term insurance to ensure the highest coverage.

● Research policies online and review claim settlement ratios.

For Mutual Funds:

● Determine your objective (whether short-term or long-term).

● Select SIPs for consistent investing.

● Utilize reputable platforms or seek advice from a SEBI-registered advisor.

Final Verdict –

If you’re wondering, “Which is better: life insurance or mutual funds?”, the best answer is both.

● Life insurance offers security for your loved ones.

● Mutual funds assist in building your wealth.

Consider them as two complementary aspects. One guarantees your family’s financial stability in your absence, while the other aids in achieving your family’s aspirations while you are present.

So don’t pick one over the other. Strategically blend them. Safeguard and thrive.

Need Assistance?

At Ginteja, we guide families throughout India in making more informed financial choices. Reach out to us today to find out how you can secure and enhance your family’s future with the ideal combination of life insurance and mutual funds.